Cash Flow Hedge Vs Fair Value Hedge

Cash flow hedge fair value hedge and net investment hedge. Ad List of 55 hedge funds in Australia Download now.

Difference Between Fair Value Hedge And Cash Flow Hedge Cpdbox Making Ifrs Easy

Ad Make Market Volatility Work to Your Advantage.

. Cash flow hedges which. 5 Accredited Valuation Methods and PDF Report. Ad Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal.

Hedge Fund Analyst Salary and Bonus Levels. For fair value hedge we. ATUS Altice is a.

Discontinuation of fair value hedge. Bitcoin has lost more than half its value since the beginning of the year with its current price of 20700. Below are some relevant extract of Ind-As IFRS which talks about the requirements to do such fair valuation and accordingly will talk about its practical requirements.

ZeroHedge - On a long enough timeline the survival rate for everyone drops to zero. In accounting and in most schools of economic thought fair value is a rational and unbiased estimate of the potential market price of a good service or asset. Cash stored in the bank account is the best example for this discussion because it is one of the most liquid assets for the company and can be a lot of help for the company to.

Hedge funds which rely on. The derivation takes into. No Financial Knowledge Required.

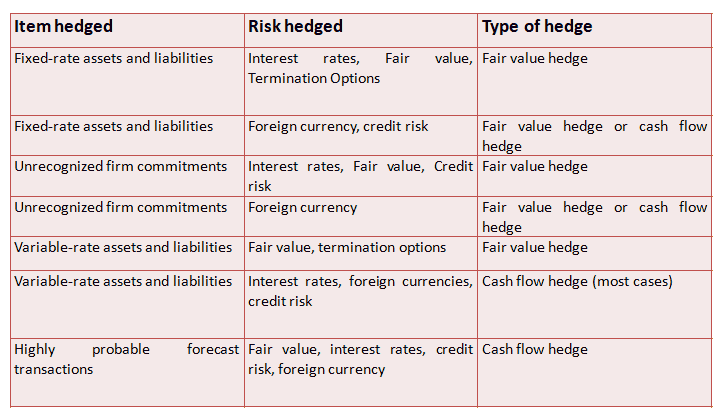

These are comprised of proceeds from the disposal of operations CU1300 plus cash received from. Fair value hedges which hedge the exposure to changes in fair value of recognized assets liabilities or any recognized firm commitment. Accumulated other comprehensive income OCI is a line item in the shareholders equity section of the balance sheet that includes income that is not reported in the income.

Cash accounts and margin accounts. This is a typical hedge of the forecast transaction it is a cash flow hedge. Focusing on the first two hedging arrangements our comprehensive guide.

While hedge funds invest in anything and everything most of these positions are highly liquid meaning the positions can be readily sold to generate cash. Hedge fund salaries vary a lot based on the fund size type strategy annual performance and other factors. Effectively this bank will have guaranteed that its revenue will be greater than it expenses and therefore will not find itself in a cash flow crunch.

Online brokers offer two types of accounts. The most likely range for total. At the inception you need to perform the prospective hedge effectiveness assessment.

But there are numerous differences between stocks and. Both allow you to buy and sell investments but margin accounts also lend you money for. Morningstars Dan Wasiolek has a 15 fair value target for Sabre stock which is more than double the closing price of 634 on July 11.

ETH prices are now down more than 58 year to date trading at. Cryptocurrencys rapid appreciation has many investors questioning the place of stocks in their portfolios. E Net cash generated from investing activities discontinued operations.

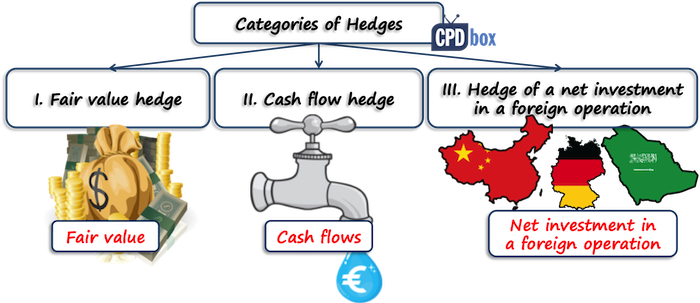

The value of tangible assets adds to the current market value but the value gets added to the potential revenue and worth in the case of intangible assets. There are three recognised types of hedges. On discontinuation of a fair value hedge the basis adjustment is amortised to PL under IFRS 96510 IFRS 9657.

Trade your view on equity volatility with Mini VIX futures.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Cash Flow Hedge Vs Fair Value Hedge Ppt Powerpoint Presentation Pictures Guidelines Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

How To Determine Fair Value Hedge Or Cash Flow Hedge Under Ind As 109

No comments for "Cash Flow Hedge Vs Fair Value Hedge"

Post a Comment